The Obama Honeymoon with Low Tax Corporations - Honest Ones, Too

With Tax Day upon us, It becomes ever more clear why some say President Obama has gotten a 'free pass' from media and corporations, many which pay zero taxes. It becomes more clear than ever that politics is all about money , especially with Obama and the Democratic Party.

We all know that the Obama Administration and the Mainstream Media have been on a permanent honeymoon since Obama came into power over seven years ago. We've heard of crony capitalism, lobby-ism and sponsor ships. Now it becomes clearer than ever how America's largest companies have been benefiting under the Obama administration and vice versa, such as exchanging votes for funding, whether through bail outs or questionable tax breaks. Other corporations have also

Media Tax Rates -2015

CBS - 5%

GENERAL ELECTRIC (NBC/MSNBC) -3%

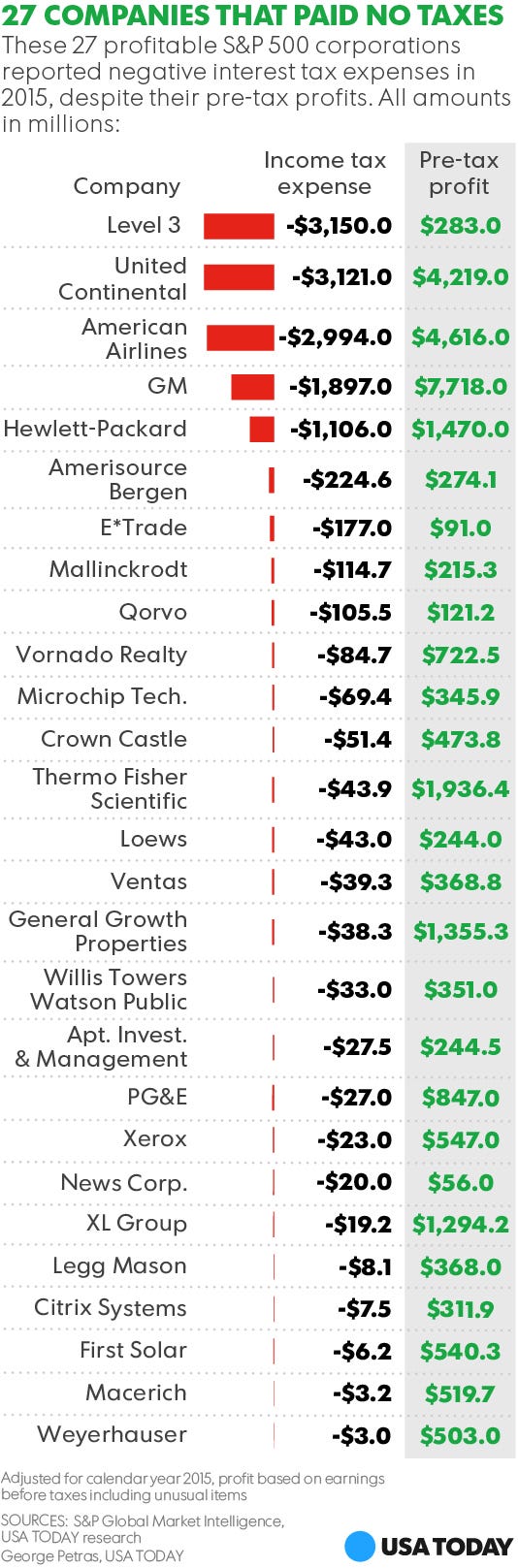

Other corporations have also benefited. Obama prides himself on the General Motors Auto Recovery that he claims came from the bailouts he gave GM and others. Now, it becomes clear that it wasn't just the bailout but that GM paid NO TAXES. Sure, there are loopholes that may, technically, allow companies to legally get away with this; however, as much as Obama has promised to close these loopholes he's done nothing about them, benefiting all the while with votes and other perks from these companies.It also helps explain Wall Street's continued climb during a weak economy.

HOW LARGE COMPANIES AVOID TAXES

Just to give credit to the honest ones,

here are

Corporations That Pay Most Taxes

1 Exxon Mobile - 31 billion

2 Chevron - 20 billion

3 Apple - 13 billion

4 Wells Fargo - 9 billion

5 Walmart - 8 billion

6 Conoco Phillips 7.9 billion

7 JP Morgan - 7.6 billion\

8 Berkshire Hathaway - 6.9 billion

9 IBM - 5 billion

10 Microsoft domestic - 5 billion

Fortune 500

No comments:

Post a Comment